Forex trade has invariably been standard, however with this economic climate has been rather more beginner Forex turning their eyes towards the trading platform of amendment. Forex stands for "foreign currency" and could be a heart pounding, adrenaline-inducing, the forex trading platform that provides normal folks such as you and me the joy of taking part and have the prospect to win huge cash. He got his begin within the early 1970's when floating currencies and free exchange rates were 1st introduced.

The Forex market is that the largest of its kind within the world, trading at quite a pair of billion bucks on a daily basis and is incredibly distinctive for several reasons. Firstly it's one among the few markets that need little or no ability and is free from any external management, can also not be manipulated in any approach that creates it ideal for any beginner Forex. the cash that's marketed through currency moves thus quick that it's not possible for any investor to substantially have an effect on the value of major currencies. There are invariably consumers and sellers for the beginner Forex to check how in contrast to any action that's rarely traded, forex traders have the flexibility to open and shut positions in seconds.

Forex beginner ought to grasp but that the achievement of advantages isn't as simple as some folks would love to try and do and if you are doing not have enough expertise, the tools or the steerage of then may realize a money hole in their pocket. quite a replacement entrant has fallen out with the joy that comes with the platform and began chasing Forex losses, creating the money hole larger and greater. this text is meant to grant beginners Forex beginning base so that they will move up the currency trader safely and begin creating cash in Forex, while not falling into the various pitfalls on the road.

1. Analysis is essential:

While several Forex beginners see analysis as mind numbingly tedious and boring, it's very important to urge a background understanding of how the Forex system. The beginner should learn forex platform they use, the time, coins, lots, a way to calculate pip and its worth and time zones. These. just some of the fundamentals, however being an expert Forex true that there are several a lot of areas that require to be learned The Forex beginner ought to browse and analysis well before investing their savings, they ought to 1st improve their skills and broaden their data. begin little and grow.

2. The automated robots will facilitate:

Beginner Forex trading isn't counseled manually to begin with the market being thus unpredictable, however you must attempt one among the various Forex robots to start with. the explanation for usually|this will be} that the Forex robots are often formed by skilled traders so that they can accurately predict market movements and this suggests it's like having an professional show you when to shop for or sell.

There are several to download Forex robots are excellent but, is usually suggested to require a glance at the paid versions like our constantly updated with current knowledge and thus, the robot can invariably trade right for you . the utilization of Forex robots isn't illegal in any case, in reality there are several massive corporations use robots and different automated systems to assist them create many cash to form selections.

3. Get a demo account:

Almost all trading platforms supply the beginner to use a Forex demo account. like any new ability, currency exchange needs time and a definite level of expertise before being sensible at it and to become a successful forex trader beginner should develop its own trading strategy that no strategy can work for all traders. With a demo account that there's no real cash concerned thus this provides the Forex beginner will acquire a a lot of strong trading platform and to check totally different methods and ideas while not financial losses.

Use the demo account for many weeks and once you feel comfy with how the trade in works to maneuver their operations into a true account, however bear in mind, if the Forex beginner sounds like you're not willing to maneuver to measure trades extremely no rush. It's far better to stay the negotiations on a demo account till they need a solid understanding of the Forex platform in order that they'll minimize the danger of errors.

4. Leave your emotions at home:

Any person who trades in Forex are known to be lots of emotions concerned. The beginner shouldn't pursue forex losses when losing a business and may not be greedy at identical time once you win. assume blocks clear overreaction and overtrading Forex beginners will shake your cash management and increase business risks. Forex could be a a part of pure gambling in a very casino, any commit to trade while not analysis or market analysis is simply a game. The games are fun, except once you lose real cash.

5. Don't risk quite a pair of.3% of your total trading:

The distinction between a successful Forex beginner and you lose the primary method are ready to survive in unfavorable market conditions, whereas the opposite loses his entire account when 10-15 unprofitable operations in a very row. Even with identical trading system operators will 2 opposite leads to the long run. The distinction is within the approach to cash management. An act quick to urge your mind wondering cash management, losing solely five hundredth of your account balance needs creating 100% come simply to revive the initial balance.

The key for beginners to make the most of Forex currency is investigating trading platform entirely, analyze market trends, check methods on a demo account and solely once they feel utterly assured that the movement of currencies for beginners to measure trades.

Visit to know more about forex trading systems

Daily Forex News Update | Best Forex Brokers Reviews | Forex Trading Systems | Learn Step By Step Online Forex Trading Strategy | Daily Forex Forecast | Daily Forex Trading Signals | How to Use Forex Trading Software

SEARCH YOUR FOREX TRADING ANSWER

Friday 30 September 2011

EURO Area Showed Inflation Unexpectedly Climbed to 3.0%

After approval of the German vote to extend the European Financial Stability Fund (EFSF), the focus is again on the fundamentals of the euro area to see how long the slowdown will continue.

The data released today by the euro zone showed inflation unexpectedly rose to 3.0%, the fastest in almost three years, adding more pressure on ECB officials before the rate decision ahead.

After the publication of the report, the euro continued its descent to play at least on the level 1.3485 from 1.3596 day.

CPI annual preliminary estimation, the main gauge of inflation in the euro area increased from 2.5% after stabilizing at that level in recent months.

The rate rose despite the decline in oil prices in September in which oil prices currently traded around $ 82.30 compared to $ 88.80 early.

In fact, the acceleration of prices means that consumer purchasing power will decrease, increasing the pressure on the economy is already suffering a slowdown, due to austerity measures taken by governments to cut the budget deficit.

The ECB raised interest rates in April and July by 50 basis points to contain inflation, even with the recent slowdown in the growth path expectations were in favor of seeing a cut in interest rates, especially as some officials ECB refers to the interest rate cut is possible action by the bank.

The ECB said in September that inflation may average 2. 6% this year and 1.7% next year.

On the other hand, the unemployment report for August showed that the rate remained at10.0%, where the number of unemployed fell by 38,000 to a total of 15.74 million.

Now, officials in the euro area face a daunting challenge to boost the slow growth and contain the debt crisis which affected the confidence in the euro area and Germany, according to reports released this week.

Yesterday, Germany ratified a plan to seize the EFSF to guarantee future loans up to € 211 billion instead of € 123 billion earlier after Merkel had achieved an overwhelming majority of 523 against 85 against and 3 abstentions.

Many economies in the euro-zone expansion plan ratified the exception of Slovakia, and noted that today Austria is expected to increase its share of € 21.64 billion from € 12.24 billion when the plan is approved Parliament.

The data released today by the euro zone showed inflation unexpectedly rose to 3.0%, the fastest in almost three years, adding more pressure on ECB officials before the rate decision ahead.

After the publication of the report, the euro continued its descent to play at least on the level 1.3485 from 1.3596 day.

CPI annual preliminary estimation, the main gauge of inflation in the euro area increased from 2.5% after stabilizing at that level in recent months.

The rate rose despite the decline in oil prices in September in which oil prices currently traded around $ 82.30 compared to $ 88.80 early.

In fact, the acceleration of prices means that consumer purchasing power will decrease, increasing the pressure on the economy is already suffering a slowdown, due to austerity measures taken by governments to cut the budget deficit.

The ECB raised interest rates in April and July by 50 basis points to contain inflation, even with the recent slowdown in the growth path expectations were in favor of seeing a cut in interest rates, especially as some officials ECB refers to the interest rate cut is possible action by the bank.

The ECB said in September that inflation may average 2. 6% this year and 1.7% next year.

On the other hand, the unemployment report for August showed that the rate remained at10.0%, where the number of unemployed fell by 38,000 to a total of 15.74 million.

Now, officials in the euro area face a daunting challenge to boost the slow growth and contain the debt crisis which affected the confidence in the euro area and Germany, according to reports released this week.

Yesterday, Germany ratified a plan to seize the EFSF to guarantee future loans up to € 211 billion instead of € 123 billion earlier after Merkel had achieved an overwhelming majority of 523 against 85 against and 3 abstentions.

Many economies in the euro-zone expansion plan ratified the exception of Slovakia, and noted that today Austria is expected to increase its share of € 21.64 billion from € 12.24 billion when the plan is approved Parliament.

Wednesday 28 September 2011

EUR / USD Rising : 1.3690 Reached During the European Session

The EUR / USD fell 1.3690 weekly highs, but managed to hold above 1.3600 and after Wall Street opened higher and above 1.3630 gathered resumed. The euro is now hovering around 1.3635/40, 0.40% above today's opening price, the benefit was a fourth consecutive day.

"EUR / USD 1.3690 reached during the European session today as optimism prevails, in addition to the Finnish Parliament approved the extension of the powers of the rescue fund the euro area (EFSF), however, from a technical perspective, the euro was unable to maintain gains and is now closer to the 1.3600 area, with indicators of less hours a little more half-lines, "said Valeria Bednarik, analyst at FXstreet. com. According to his just below 1.3600, the bearish potential may increase.

"We have outbreaks of head on the hourly chart and what we can imagine a test of recent highs in the middle, but we can too easily imagine that the collapse in the euro to test the latest low of 1. 3360, which came just two days ago, "says Barbara Rockefeller of Rockefeller Treasury Services Inc. She says the use of a linear regression channel as a guide, you can see the euro hit 1.3100 on Friday, about noon of America." The linear channel has serious limitations as a guide, but no matter, if the market jumps that way, the channel offers the worst case and these are not times to be ignoring the worst-case scenario. "

"EUR / USD 1.3690 reached during the European session today as optimism prevails, in addition to the Finnish Parliament approved the extension of the powers of the rescue fund the euro area (EFSF), however, from a technical perspective, the euro was unable to maintain gains and is now closer to the 1.3600 area, with indicators of less hours a little more half-lines, "said Valeria Bednarik, analyst at FXstreet. com. According to his just below 1.3600, the bearish potential may increase.

"We have outbreaks of head on the hourly chart and what we can imagine a test of recent highs in the middle, but we can too easily imagine that the collapse in the euro to test the latest low of 1. 3360, which came just two days ago, "says Barbara Rockefeller of Rockefeller Treasury Services Inc. She says the use of a linear regression channel as a guide, you can see the euro hit 1.3100 on Friday, about noon of America." The linear channel has serious limitations as a guide, but no matter, if the market jumps that way, the channel offers the worst case and these are not times to be ignoring the worst-case scenario. "

Monday 19 September 2011

Forex - Dollar higher against rivals such as euro falls on fears of Greece

Forex News- The U.S. dollar was higher against all its major counterparts Monday as the euro weakened broadly after a weekend meeting of European finance ministers failed to progress in solving the region's financial crisis.

In the European morning, the dollar was strong against the euro, with EUR / USD fell 0.93% to 1.3670 hit.

Concern about a possible breach by Greece intensified after the European Union finance ministers warned that it may withhold the next tranche of Greece if Athens rescue aid does not meet the deficit reduction targets.

The dollar was lower against the pound, with GBP / USD shedding 0.38% to reach 1.5731.

Earlier Monday, the Bank of England quarterly bulletin said the bonus plan with a purchase option was implemented between March 2009 and early 2010 had an "economically significant" effect on Britain's financial system, but said the impact of future purchases may differ.

The dollar also rose against the yen and Swiss franc, with USD / JPY inching up to 0.10%, to 76.87 and USD / CHF advancing 0.78% to reach 0.8825.

In addition, the stronger dollar against its Canadian cousins Zealand, Australia and New, with USD / CAD up 0.9824 0.46% to hit, AUD / USD fell 1.13% to reach 1.0244 and NZD / USD shedding 0.67% to reach 0.8233.

Earlier in the day, a report showed that the rate of New Zealand Westpac consumer confidence stood at 112 in the September quarter, as consumers remained upbeat, but the long-term confidence fell.

Meanwhile, the Australian dollar was weighed by speculation about a possible rate cut by the central bank before the release of the minutes of the monetary policy meeting this month on Tuesday.

The dollar index, which tracks the performance of the greenback against a basket of six currencies, rose 0.76%, to 77.64.

Later in the day, officials of the EU and the International Monetary Fund were to hold talks with Greek Finance Minister Evangelos Venizelos to discuss additional steps to ensure you can qualify for Athens next installment of the bailout funds.

Also Monday, U.S. President Barack Obama would talk about the economy, in Washington.

In the European morning, the dollar was strong against the euro, with EUR / USD fell 0.93% to 1.3670 hit.

Concern about a possible breach by Greece intensified after the European Union finance ministers warned that it may withhold the next tranche of Greece if Athens rescue aid does not meet the deficit reduction targets.

The dollar was lower against the pound, with GBP / USD shedding 0.38% to reach 1.5731.

Earlier Monday, the Bank of England quarterly bulletin said the bonus plan with a purchase option was implemented between March 2009 and early 2010 had an "economically significant" effect on Britain's financial system, but said the impact of future purchases may differ.

The dollar also rose against the yen and Swiss franc, with USD / JPY inching up to 0.10%, to 76.87 and USD / CHF advancing 0.78% to reach 0.8825.

In addition, the stronger dollar against its Canadian cousins Zealand, Australia and New, with USD / CAD up 0.9824 0.46% to hit, AUD / USD fell 1.13% to reach 1.0244 and NZD / USD shedding 0.67% to reach 0.8233.

Earlier in the day, a report showed that the rate of New Zealand Westpac consumer confidence stood at 112 in the September quarter, as consumers remained upbeat, but the long-term confidence fell.

Meanwhile, the Australian dollar was weighed by speculation about a possible rate cut by the central bank before the release of the minutes of the monetary policy meeting this month on Tuesday.

The dollar index, which tracks the performance of the greenback against a basket of six currencies, rose 0.76%, to 77.64.

Later in the day, officials of the EU and the International Monetary Fund were to hold talks with Greek Finance Minister Evangelos Venizelos to discuss additional steps to ensure you can qualify for Athens next installment of the bailout funds.

Also Monday, U.S. President Barack Obama would talk about the economy, in Washington.

Higher Dollar Powers on the new Euro zone fears

- Euro affected by the lack of progress by the ministers in the debt crisis

- South Korea, Indonesia to intervene to defend their currencies

- The eyes of the Fed, the IMF, the BRIC meetings this week

By Martin Vaughan and Gaurav Raghuvanshi

Dow Jones Newswires

SINGAPORE - (Dow Jones) - The dollar rose against the euro and other currencies sensitive to risk, on Monday, when the failure of European authorities to show progress in containing the crisis in the euro zone debt weakened appetite risk.

Authorities in South Korea and Indonesia were suspected of selling dollars to halt slide of their currencies as risk aversion fueled the outputs of the emerging markets. The Korean won was at its lowest level in nearly six months, while the Singapore dollar also fell to a minimum of five months.

With Tokyo markets closed for a national holiday and little in the timing of the data for Asia, market players stuck to the disappointing news of the weekend meeting of European finance ministers in Wroclaw, Poland.

"It still sounds like there is little coordination among EU leaders to resolve the crisis," said quarterback Mike Burrowes BNZ in Wellington.

The ministers warned that can hold the next leg of the Greek aid, EUR 8 million due in October, if Athens does not take decisive action. The Greek Prime Minister George Papandreou, canceled a trip to the U.S. perform crisis meetings, continues on Monday, but the Finance Minister Evangelos Venizelos said it is "threatened and humiliated" by the demands of the EU, the IMF and the ECB.

A setback for the weekend, German Chancellor Angela Merkel, as a member of his government coalition, the Free Democrats, was crushed in elections in Berlin, also feeds on the weak euro and added to general caution in the currency markets.

Dealers see up close a meeting on Tuesday and Wednesday of the U.S. Federal Reserve for signs of further expansion, which could eat into profits in the dollar and the risk of past support.

"Overall, the week starts with nervousness and probably how to be a week the risk of closure unless the Fed will give a much needed boost to confidence," said Mitul Kotecha, head of global FX strategy at Credit Agricole in a note.

The meetings start later this week the International Monetary Fund, the Group of Seven and the Group of 20 also will be watched closely by efforts to support the euro area - in particular the BRIC emerging powers Brazil, Russia, India, China and South Africa.

The euro was at $ 1.3673 at 0631 GMT, compared with $ 1.3802 late Friday in New York. The yen was stable at low volumes, Tokyo traders absent. The dollar was at Y76.87 in Asia, little changed from Y76.82 late Friday.

The pound was U.S. $ 1. 5699 after falling to a minimum of eight months of 1.5685 $ 1.5790 Friday. The Australian dollar was at $ 1.0231 from $ 1.0362 in New York on Friday.

Interbank Foreign Exchange Rates At 01:50 EST / 0550 GMT

Latest Previous %Chg Daily Daily %Chg

Dollar Rates Close High Low 12/31

USD/JPY Japan 76.90-92 76.91-97 -0.04 76.98 76.88 -5.19

EUR/USD Euro 1.3658-60 1.3691-95 -0.25 1.3711 1.3648 +2.00

GBP/USD U.K. 1.5699-702 1.5730-36 -0.21 1.5749 1.5686 +0.59

USD/CHF Switzerland 0.8825-30 0.8804-14 +0.21 0.8832 0.8802 -5.59

USD/CAD Canada 0.9838-44 0.9789-92 +0.52 0.9845 0.9792 -1.07

AUD/USD Australia 1.0224-28 1.0367-70 -1.37 1.0368 1.0214 -0.08

NZD/USD New Zealand 0.8220-26 0.8292-98 -0.86 0.8292 0.8220 +5.47

EUR/JPY Japan 105.02-06 105.26-41 -0.28 105.46 104.98 -3.31

--By Martin Vaughan, Dow Jones Newswires; +65 6415 4033; martin.vaughan@

dowjones.com

- South Korea, Indonesia to intervene to defend their currencies

- The eyes of the Fed, the IMF, the BRIC meetings this week

By Martin Vaughan and Gaurav Raghuvanshi

Dow Jones Newswires

SINGAPORE - (Dow Jones) - The dollar rose against the euro and other currencies sensitive to risk, on Monday, when the failure of European authorities to show progress in containing the crisis in the euro zone debt weakened appetite risk.

Authorities in South Korea and Indonesia were suspected of selling dollars to halt slide of their currencies as risk aversion fueled the outputs of the emerging markets. The Korean won was at its lowest level in nearly six months, while the Singapore dollar also fell to a minimum of five months.

With Tokyo markets closed for a national holiday and little in the timing of the data for Asia, market players stuck to the disappointing news of the weekend meeting of European finance ministers in Wroclaw, Poland.

"It still sounds like there is little coordination among EU leaders to resolve the crisis," said quarterback Mike Burrowes BNZ in Wellington.

The ministers warned that can hold the next leg of the Greek aid, EUR 8 million due in October, if Athens does not take decisive action. The Greek Prime Minister George Papandreou, canceled a trip to the U.S. perform crisis meetings, continues on Monday, but the Finance Minister Evangelos Venizelos said it is "threatened and humiliated" by the demands of the EU, the IMF and the ECB.

A setback for the weekend, German Chancellor Angela Merkel, as a member of his government coalition, the Free Democrats, was crushed in elections in Berlin, also feeds on the weak euro and added to general caution in the currency markets.

Dealers see up close a meeting on Tuesday and Wednesday of the U.S. Federal Reserve for signs of further expansion, which could eat into profits in the dollar and the risk of past support.

"Overall, the week starts with nervousness and probably how to be a week the risk of closure unless the Fed will give a much needed boost to confidence," said Mitul Kotecha, head of global FX strategy at Credit Agricole in a note.

The meetings start later this week the International Monetary Fund, the Group of Seven and the Group of 20 also will be watched closely by efforts to support the euro area - in particular the BRIC emerging powers Brazil, Russia, India, China and South Africa.

The euro was at $ 1.3673 at 0631 GMT, compared with $ 1.3802 late Friday in New York. The yen was stable at low volumes, Tokyo traders absent. The dollar was at Y76.87 in Asia, little changed from Y76.82 late Friday.

The pound was U.S. $ 1. 5699 after falling to a minimum of eight months of 1.5685 $ 1.5790 Friday. The Australian dollar was at $ 1.0231 from $ 1.0362 in New York on Friday.

Interbank Foreign Exchange Rates At 01:50 EST / 0550 GMT

Latest Previous %Chg Daily Daily %Chg

Dollar Rates Close High Low 12/31

USD/JPY Japan 76.90-92 76.91-97 -0.04 76.98 76.88 -5.19

EUR/USD Euro 1.3658-60 1.3691-95 -0.25 1.3711 1.3648 +2.00

GBP/USD U.K. 1.5699-702 1.5730-36 -0.21 1.5749 1.5686 +0.59

USD/CHF Switzerland 0.8825-30 0.8804-14 +0.21 0.8832 0.8802 -5.59

USD/CAD Canada 0.9838-44 0.9789-92 +0.52 0.9845 0.9792 -1.07

AUD/USD Australia 1.0224-28 1.0367-70 -1.37 1.0368 1.0214 -0.08

NZD/USD New Zealand 0.8220-26 0.8292-98 -0.86 0.8292 0.8220 +5.47

EUR/JPY Japan 105.02-06 105.26-41 -0.28 105.46 104.98 -3.31

--By Martin Vaughan, Dow Jones Newswires; +65 6415 4033; martin.vaughan@

dowjones.com

Euro Faling This Week

The euro rallied last week, according t helped by a major central banks to provide unlimited dollar liquidity, and the Franco-German support for Greece, but the landscape looks a little different this weeks, according to Mansoor Mohi-Uddin, head of currency strategy at UBS, who sees the winds against the euro this week suffers.

The euro is expected to fall this week on concerns of the EU financial aboutrt the situation, says Mansoor, and even more likely pacifist turn at the next meeting of the ECB Monthly: "Financial markets remain concerned about establishing sustainability sovereign debt in the euro zone last., the euro is likely to decline again as we head towards the next monthly meeting of the ECB, Trichet, the president amid fears will be ready to cut interest rates at its last meeting before retiring. "

The euro is expected to fall this week on concerns of the EU financial aboutrt the situation, says Mansoor, and even more likely pacifist turn at the next meeting of the ECB Monthly: "Financial markets remain concerned about establishing sustainability sovereign debt in the euro zone last., the euro is likely to decline again as we head towards the next monthly meeting of the ECB, Trichet, the president amid fears will be ready to cut interest rates at its last meeting before retiring. "

EUR/USD Today's Technical Report 09.19

EUR / USD: The sharp drop below the lows of July and the establishment below 200 day SMA solidifies the potential of the stature of a major top low monthly figure now in the end, projects Additional reductions to the 1.2000 area in the coming weeks and months. The last days at rally outside the area of 1.3500 lows has stalled out at our projected lower region between 1.3835 and 1.4055 higher and a break back below 1.3500 will confirm the minimum point in 1.3940 and accelerate declines down towards 1.3000. Ultimately, only back above 1.3940 delays perspective and gives reason for pause.

Written by Joel Kruger, Technical Currency Strategist for DailyFX.com

Written by Joel Kruger, Technical Currency Strategist for DailyFX.com

Today's EUR/USD Forecast

The pair is trading along an downtrend.

The downtrend may be expected to continue from current levels, which will be followed by reaching support level 1.5550.

An uptrend will start as soon as the pair rises above resistance level 1.5800, which will be followed by moving up to resistance level 1.5960.

Resistances: 1.5765, 1.5800, 1.5960, 1.6050

Supports: 1.5550

The downtrend may be expected to continue from current levels, which will be followed by reaching support level 1.5550.

An uptrend will start as soon as the pair rises above resistance level 1.5800, which will be followed by moving up to resistance level 1.5960.

Resistances: 1.5765, 1.5800, 1.5960, 1.6050

Supports: 1.5550

Forex Technical Update

EUR / USD: Euro is trading at 1.3663 levels. The euro is weak against the dollar as the official euro area disagree on the approaches to stem the debt crisis of the Euro zone. Current a / c data was weaker euro last Friday. Support is seen around 1.3577 and resistance levels seen in the levels of 1.3764 (21 days every 4 hours EMA). EUR / INR is at 65.19 levels. Exporters can cover short-term exposure at current levels while importers can hedge the exposure to levels of 64 and below. EUR / INR is likely to trade in the range of65.00 and 66.50 levels. Short term: Bearish Bearish Medium Term. 1.3500-1.3600 next target.

GBP / USD: GBP is currently trading at 1.5701 levels. The monitor cable is weak due to weak euro and risk aversion in the global market. Support is seen around 1.5574 and resistance levels seen in the levels of 1.5786 (21 days per day EMA). GBP / EUR (74. 86) The exporters can cover short-term exposure to current levels and a little more, while importers in the short term can cover on dips to 74 and below levels. GBP / INR is likely to trade in the range of 74.50 and 75.20 at current levels. In the short term and medium term bearish downtrend. Next Target: 1.5600

USD / JPY: Yen is trading at 76.89 levels. Support is seen at around 76.29 levels whereas resistance is seen at 77.59 levels (day 55 days EMA). Yen Exporting book suggests some exposure to current levels and importers can cover above the 78.50 level. Outlook: Short-term term bearish light and medium enterprises: Keep bearish for the pair. USD / JPY should be at levels of 76-78 with a bearish bias.

AUD / USD is quoted at U.S. $ 1.0251 level. The currency is weak against dollar básicosel products through the global economy is losing momentum problems, such as euro zone leaders disagree over approaches to contain the euro zone debt crisis, falling demand for higher-yielding assets. Support is seen around 1.0178 and resistance levels seen in the levels of 1.0320 (4 HRLY 21 days EMA). Exporters are suggested for the exhibition and book at 1.0500, while the levels of imports can partly cover its short-term exposure to 1.0200and more falls. Short-term: bearish medium-term: bearish. Target almost reached 1.0200.

Oil: Oil is trading at 87.04 levels. Oil is under selling pressure on speculation that fuel demand will falter amid slower economic growth in Europe and U.S., the world's largest consumer of crude. Support is seen at around 83.34 levels whereas resistance is seen at 90.83 levels (55 days a week EMA). Short-term outlook bearish medium term bearish. Goal of 84 levels.

Gold: Gold is trading at 1822.90 levels. The gold is positive as investors continue to flock to the safety of the precious metal amid signs of global growth is weakening. Support is seen at around 1794.84 and the level of resistance is seen at around 1839.36 Gold levels.Outlook is undergoing consolidation. Stay away from long until we see significant corrections.

Dollar Index: DI currently trading at 77.04 levels. Strong dollar is in the midst of risk aversion in world financial markets amid signs that the euro leaders are struggling to contain the debt crisis of the Euro zone. Support is seen at 76.25 levels (200 days to the day EMA) and the resistance is seen at 77.87 levels (100 days a week EMA). Outlook remains very optimistic for the short and medium term: bullish. 76 Goal Attainment. Next target of 78 to 78.50 levels.

GBP / USD: GBP is currently trading at 1.5701 levels. The monitor cable is weak due to weak euro and risk aversion in the global market. Support is seen around 1.5574 and resistance levels seen in the levels of 1.5786 (21 days per day EMA). GBP / EUR (74. 86) The exporters can cover short-term exposure to current levels and a little more, while importers in the short term can cover on dips to 74 and below levels. GBP / INR is likely to trade in the range of 74.50 and 75.20 at current levels. In the short term and medium term bearish downtrend. Next Target: 1.5600

USD / JPY: Yen is trading at 76.89 levels. Support is seen at around 76.29 levels whereas resistance is seen at 77.59 levels (day 55 days EMA). Yen Exporting book suggests some exposure to current levels and importers can cover above the 78.50 level. Outlook: Short-term term bearish light and medium enterprises: Keep bearish for the pair. USD / JPY should be at levels of 76-78 with a bearish bias.

AUD / USD is quoted at U.S. $ 1.0251 level. The currency is weak against dollar básicosel products through the global economy is losing momentum problems, such as euro zone leaders disagree over approaches to contain the euro zone debt crisis, falling demand for higher-yielding assets. Support is seen around 1.0178 and resistance levels seen in the levels of 1.0320 (4 HRLY 21 days EMA). Exporters are suggested for the exhibition and book at 1.0500, while the levels of imports can partly cover its short-term exposure to 1.0200and more falls. Short-term: bearish medium-term: bearish. Target almost reached 1.0200.

Oil: Oil is trading at 87.04 levels. Oil is under selling pressure on speculation that fuel demand will falter amid slower economic growth in Europe and U.S., the world's largest consumer of crude. Support is seen at around 83.34 levels whereas resistance is seen at 90.83 levels (55 days a week EMA). Short-term outlook bearish medium term bearish. Goal of 84 levels.

Gold: Gold is trading at 1822.90 levels. The gold is positive as investors continue to flock to the safety of the precious metal amid signs of global growth is weakening. Support is seen at around 1794.84 and the level of resistance is seen at around 1839.36 Gold levels.Outlook is undergoing consolidation. Stay away from long until we see significant corrections.

Dollar Index: DI currently trading at 77.04 levels. Strong dollar is in the midst of risk aversion in world financial markets amid signs that the euro leaders are struggling to contain the debt crisis of the Euro zone. Support is seen at 76.25 levels (200 days to the day EMA) and the resistance is seen at 77.87 levels (100 days a week EMA). Outlook remains very optimistic for the short and medium term: bullish. 76 Goal Attainment. Next target of 78 to 78.50 levels.

Thursday 15 September 2011

Make Money From Online Trading Forex

Would you like to guess why you're here on this page? Of course, because you are interested in currency trading, and because he wants to make money trading forex! Otherwise, I would not be reading this article. Let me congratulate you - you're on the right track. But surely you need a little knowledge to make money trading!

It's hard to believe, but recently the forex market was only useful for people working in banks and so on. Now almost everyone can make money forex trade fair home. Yes! You are right - from there you are sitting in the now! Currency trading is easier than ever - well, you can operate even from the couch, feeling comfortable. Trade through the Internet is easy. But there are some things that I advise you do to feel more comfortable.

Learn the basics

First, this page can provide many different things, but my article. As an example, Tutorials Forex Trading. You may ask - why need this? Because knowledge about the Forex market will help you succeed - the Forex market is large and the tutorials are easy to use and learn. If you want to make money trading forex, then, to learn more about forex trading of our tutorials is undoubtedly the best option.

Choose a Forex trading system

So ... You must choose a currency exchange system powerful. It means a lot, because with the wrong system can fail quickly, which means you will waste time and money. ForexEASystems provides professional systems change operations, which will help them succeed. They are easy to install, tested with historical data for 10 years and more often and before examined. Compare Forex Trading Systems, traits and characteristics.

Choose a Broker Confident

Third, to make money trading Forex you should find a good forex broker. I do not think he'll try to sell your apartment or house without an agent today? Market can be aggressive, especially for newbies, so just have to have a trusted agent you can trust. What you should look for:

Support - How fast does your answer help desk.

Spread - Is the broker offering competitive spreads.

Regulation - Is the broker regulated. Stay away from the corridors of the high seas!

I'm sure you will choose between good! If you do not know where to start your search corridor, take a look at the downloads section of our website. We have prepared a long list Metatrader Forex broker.

Start

And now we're here for the main thing! Start trading. Now that you know everything you need to know is to have a good system and running - it is ready. Earn money with Forex trading can be very easy and pleasant - the market closes at 6 pm or 21:00 or any time ... It is open 24 / 7 for those who want to make money trading forex. You do not need to go out in the rain and quickly to your workplace if you are working at home ... What? Where are you? Dreaming of Forex trading from the comfort of your home? Stop dreaming and start doing. Choose one of our automated Forex and start.

It's hard to believe, but recently the forex market was only useful for people working in banks and so on. Now almost everyone can make money forex trade fair home. Yes! You are right - from there you are sitting in the now! Currency trading is easier than ever - well, you can operate even from the couch, feeling comfortable. Trade through the Internet is easy. But there are some things that I advise you do to feel more comfortable.

Learn the basics

First, this page can provide many different things, but my article. As an example, Tutorials Forex Trading. You may ask - why need this? Because knowledge about the Forex market will help you succeed - the Forex market is large and the tutorials are easy to use and learn. If you want to make money trading forex, then, to learn more about forex trading of our tutorials is undoubtedly the best option.

Choose a Forex trading system

So ... You must choose a currency exchange system powerful. It means a lot, because with the wrong system can fail quickly, which means you will waste time and money. ForexEASystems provides professional systems change operations, which will help them succeed. They are easy to install, tested with historical data for 10 years and more often and before examined. Compare Forex Trading Systems, traits and characteristics.

Choose a Broker Confident

Third, to make money trading Forex you should find a good forex broker. I do not think he'll try to sell your apartment or house without an agent today? Market can be aggressive, especially for newbies, so just have to have a trusted agent you can trust. What you should look for:

Support - How fast does your answer help desk.

Spread - Is the broker offering competitive spreads.

Regulation - Is the broker regulated. Stay away from the corridors of the high seas!

I'm sure you will choose between good! If you do not know where to start your search corridor, take a look at the downloads section of our website. We have prepared a long list Metatrader Forex broker.

Start

And now we're here for the main thing! Start trading. Now that you know everything you need to know is to have a good system and running - it is ready. Earn money with Forex trading can be very easy and pleasant - the market closes at 6 pm or 21:00 or any time ... It is open 24 / 7 for those who want to make money trading forex. You do not need to go out in the rain and quickly to your workplace if you are working at home ... What? Where are you? Dreaming of Forex trading from the comfort of your home? Stop dreaming and start doing. Choose one of our automated Forex and start.

Wednesday 14 September 2011

HotForex Review

HotForex (licensed under the name HF Markets Ltd.) is an ECN Forex broker that offers competitive trading conditions and a wider range of currency pairs than most other ECN brokers offer. Although it offers the standard MetaTrader4 platform, few other aspects of this brokerage are standard, including its wide range of major and exotic currency pairs and a website available in 10 somewhat uncommon languages. Peruse this comprehensive HotForex review to see if HotForex is hot…or not.

General Information

Founded in: 2010

Headquarters: Mauritius

Maximum leverage: 1:500

Minimum deposit: $5 (Micro Account)

Minimum lot size: 0.01 lots

Languages available: English, Arabic, Russian, Spanish, Chinese, Farsi, Indonesian, Thai, Japanese, Georgian

Regulation: FSC

Trading Platform

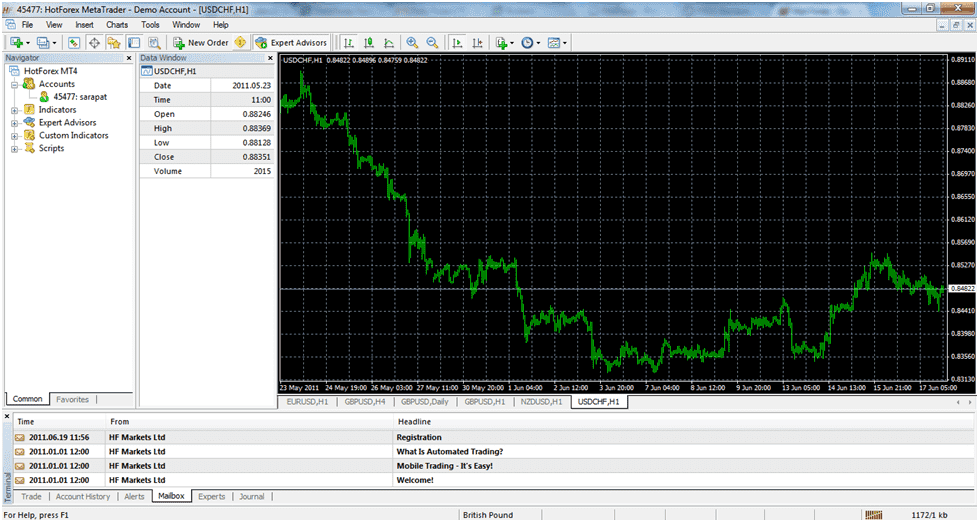

HotForex trading platform (Click image to enlarge)

HotForex offers a standard MT4 trading platform that can be downloaded directly onto the trader’s desktop. The broker’s MT4 platform is also available in PDA and smartphone versions for traders who enjoy trading on the go. The Hot WebTrader is also available for those who prefer a browser-based Forex trading platform. We appreciated the ability to choose between these two platforms, especially since many other brokers offer MT4 only, and this platform, although popular, is not suitable for every trader.

Features

Unlike other broker websites that flaunt Forex education centers or trading tools, the HotForex website focuses almost exclusively on the company’s favorable trading conditions and rollover policies. Still, HotForex does offer an ample Forex education center as well as notable trading tools for those who look at the bottom of the website instead of at the top. Among the tools we appreciated most during our HotForex review were the Fibonacci calculator, the Pivot Point calculator and the pip calculator, none of which are specifically unique, but all of which are useful for intermediate to advanced Forex traders.

What we found even more helpful though was the free access to TradeSignals.com (with a standard account) and the choice between a 50% withdrawal bonus and a 15% rescue bonus, both of which are worthwhile, if you ask us.

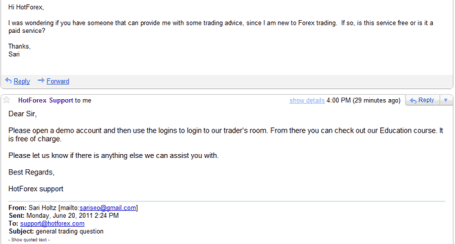

Customer Support

When it comes to customer support, the HotForex team is both transparent and available. International phone numbers are available in 10 different languages, and email queries can be sent to 6 different virtual destinations, to ensure that they’re reaching the right desk. We emailed the HotForex team on a Monday and received a response in 1 hour and 40 minutes, which was quite a fair response time.

Email from HotForex (Click image to enlarge)

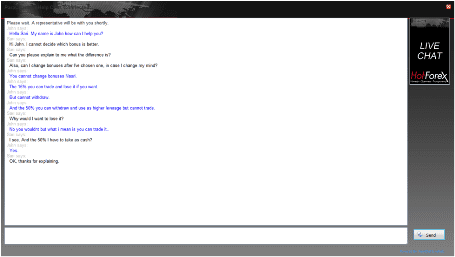

Chat support is also available 24/5. During our HotForex review we had the opportunity to chat with the support team multiple times and we repeatedly received courteous, helpful service.

Chat with HotForex (Click image to enlarge)

Ease of Use

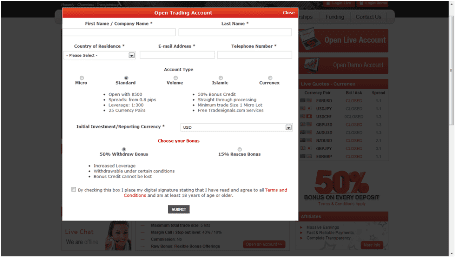

Registering for HotForex was markedly easier than registering for many other Forex brokers, because traders are able to choose their account type directly in the registration page, and to compare all account options directly on the registration page before making this decision. We were also relieved by the fact that we didn’t need to answer pages of probing personal questions we did with some other brokers. Submitting identification documents is required in order to finalize the opening of a live account. Two forms of identification are required. The first is a national ID such as a driver’s license, passport or government-issued ID. The other is a confirmation of address in the form of a bill or bank statement. A government-issued ID may also be used for this purpose if it has an address on it.

HotForex registration popup (Click image to enlarge)

Registration for HotForex is done in a popup window that allows you to choose your account type straight off, a feature that found extremely useful. The details of each account change depending on which account type is checked off. Likewise, traders can choose between two different bonuses when they open their live account.

One thing we noticed that was a bit unexpected was that while the site is available in 10 different (and slightly unusual) languages, deposits can only be made in EUR and USD. Likewise, HotForex accepts seven different funding options including credit card, wire transfer, AlertPay, Webmoney, PerfectMoney, Neteller and China UnionPay, but we noticed PayPal and MoneyBookers as popular options that were missing from this list. Still, there were more than ample options to choose from and we had no trouble funding or withdrawing from our HotForex account. We were also satisfied that payments are processed within 24 hours and not within 42 or 72 hours which is standard for many other Forex brokers.

Finally, we were impressed to see that trades can be closed by phone in the event that access to the trading platform isn’t available or the trader has connectivity issues, and that traders with all account types can benefit from this service.

Final Thoughts

HotForex caters both to new traders and advanced traders, though throughout our HotForex review we couldn’t help feel that experienced traders might find more to love about this brokerage, because of their interesting currency pairs and availability of the MT4 platform only. If you’re looking for an ECN broker with fast execution, competitive trading conditions and exotic currency pairs, HotForex may be just the broker for you.

JZRFC9QH4RGW

Subscribe to:

Posts (Atom)

Forex Trading Article Catagory

after weak data

(1)

AUDJPY formed head and shoulders neckline

(1)

bank of england

(1)

best forex trading indicators

(1)

Dollar higher against rivals such as euro falls on fears of Greece

(1)

ECB interest rates

(1)

EUR / USD Rising During the European Session

(1)

EUR/USD Falls More Than 400 Pips in Last Two Days

(1)

EUR/USD Forecast

(1)

EUR/USD Today's Technical Report 09.19

(1)

eurjpy news

(1)

EURO Area Showed Inflation Unexpectedly

(1)

Euro Faling This Week

(1)

euro zone economy

(1)

Foreign exchange reserves

(1)

Forex - EUR / CHF

(1)

Forex - EUR/USD Drops In The Asian Trading Session

(1)

Forex EUR/USD

(1)

Forex EUR/USD trending down for FOMC Statement

(1)

forex fundamental analysis

(1)

forex market

(1)

forex news

(1)

forex news today: eur usd going up from asian trading session

(1)

Forex News- GBP/USD Down in Asian Trading Session

(1)

Forex news: GBP / USD

(1)

Forex News: The U.S. Dollar Turned Down Sharply Against Major Currencies After Six Major Central Banks Announcement

(1)

Forex Technical Update

(1)

Forex trading safely with expert traders

(1)

Forex Trading Tips For New Traders

(1)

Forex-EUR/USD Moving Upward at Mid of US Session

(1)

Forex: EUR/GBP Bouncing From 0.8589 to 0. 86390 Now

(1)

Higher Dollar Powers on the new Euro zone fears

(1)

HotForex Review

(1)

in the euro zone

(1)

Make Money From Online Trading Forex

(1)

Online Trading Forex

(2)

profitable forex trading systems

(2)

safe forex trading system

(1)

The euro fell on Thursday

(1)

The Euro Sank Eight-month Low on Monday

(1)

UK and international awareness

(1)

USD/CHF forex trade

(1)

USD/JPY Facing Selling Pressure in Asian Trading Session

(1)